Divested

I've divested StarHub before their 3Q16 results announcement after considering various points and thought it'll be a good time to do so before their announcement.

Weak outlook on Mobile

Mobile segment outlook is very weak, and especially so for StarHub and M1. This is affirmed by their 3Q announcement vis a vis Singtel's announcement.Pricing pressure from the impending 4th Telco arrival has took a toll on M1 and StarHub.

Defensive Mode

StarHub's management has been on a defensive mode with regards to their earnings call.They attributed their fall in Mobile earnings to

- IDD and International Roaming calls (as usual)

- Not pricing pressure from their data upsize point of view.

Management's response was that their move was not aggressive. They even attempted to assured investors by saying that what they're seeing is that consumers are not downgrading their plans but instead, increasing their subscription to the Plus 3 option due to increase in data consumption.

Now, these are all nice to hear. But it's essentially useless if their revenue does not show otherwise.

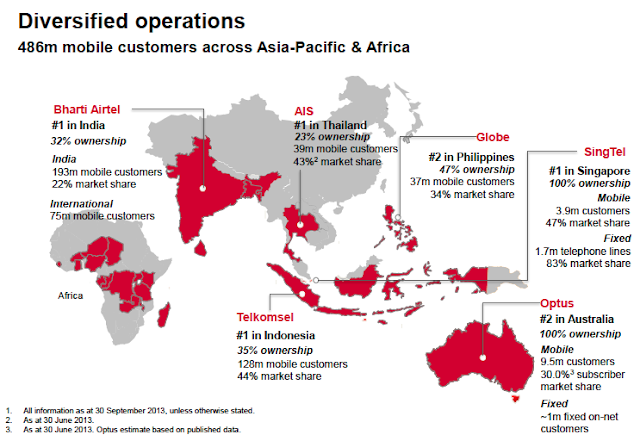

Singtel, meanwhile, has managed to stabilised their Mobile revenue despite falling voice revenue with strong data growth. They've put their money where their mouth is.

Weak PayTV vs Singtel

StarHub's and Singtel's PayTV subscribers are lowering quarter on quarter. However, the similarity stops here.Singtel has managed to increase their revenue while StarHub's PayTV revenue is falling together with its smaller subscribers' base.

In response to analysts' question, StarHub is again on the defensive mode saying

- Working hard on content

- StarHub Go is there

- Netflix and other illegal options are there all along

Again, these are nice to hear until your revenue shows otherwise.

Meanwhile, Singtel has somehow managed to increase their PayTV revenue even when excluding BPL subscriptions.

Also, I remember them saying this on their previous earning calls in response to analysts

- Cutting the cord in other countries will not be seen on the same scale here

- StarHub has local contents that prevents consumers from cutting cords (as the OTT options do not have significant asian content)

- Netflix via VPN is already available long before, together with illegal setup box, and StarHub has been unfazed.

- StarHub Go will address the OTT options

Yet now, look at their PayTV segment. They must be eating their words.

Meanwhile, Singtel:

- Partnered with Netflix

- Has VIU, CAST to countered the OTT options

- BPL is really helping their revenue (although their profitability on BPL remains questionable).

Hubbing (their Trump Card) is weakening as well

Even their Hubbing households (which Management has been trumpeting forever, is falling for the second or third quarter).

No competitive advantage left

In summary, why i decided to divest before their 3Q announcement- Unable to stem the falling of their PayTV business (unlike Singtel)

- Unable to manage their Mobile revenue fall (unlike Singtel)

- Enterprise growth seemed to have stalled

- Price points are not the cheapest (vs M1), yet not the most expensive (for investor's benefit).

When you're neither here nor there, and have no clear competitive advantage, I'm not comfortable being your long-term shareholder as I've no confidence in your management skills.

For now, I'm still closely monitoring M1, and will divest if need be. At least now, they're the "cheapest" in the market.