In my previous post, I talked about my "watch list" for this mini buffet STI is experiencing. Here, I'll discuss if Singtel is a good enough stock to accumulate.

In my previous post, I talked about my "watch list" for this mini buffet STI is experiencing. Here, I'll discuss if Singtel is a good enough stock to accumulate.Full fledged Telco

Like StarHub, Singtel has the full range of telco services: Mobile, Fixed lines (Broadband), TV. This aids in Singtel's stickiness with its customer in Singapore as the company can bundle their products and lower the churn rate.

Diversification of revenue stream

Business Segments

Consumers, Enterprise (Corporate Business), Digital Life (Advertising) taking 61%, 37% and 3% of revenue respectively. Enterprise segment sees Singtel enjoying inelastic prices with its large enterprises and thus resilient to "new players".

Geographic

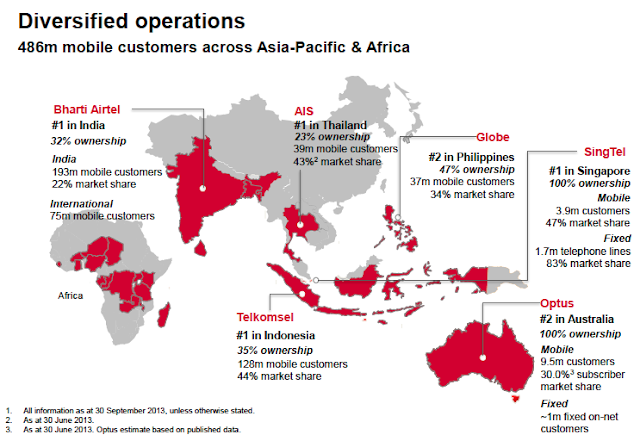

EBITDA and share of Associates split - Consumer Segment

Singapore, 100% owned (13%)

Australia, 100% owned (45%)

Associates (42%)

- Indonesia,Africa (16%)

- India (12%)

- Thailand (8%)

- Philippines (6%)

The recent 4th telco scare in Singapore, if materialise, would have little impact to Singtel's bottom-line.

However, the wide diversification of Singtel's revenue makes the company vulnerable to currency volatility.

Market Leader

Similar to SATS, Singtel is a leader in its investments.

Singapore (Singtel) - 1st in market share

Australia (Optus) - 2nd in market share

Indonesia (Telkomsel) - 1st in markset share

India (Airtel) - 1st in market share

Thailand (AIS) - 1st in market share

Philippines (Globe) - 2nd in market share

Historically, being a telco market leader also meant that its market share is unlikely to change significantly (even with the introduction of new players) due to its inherent brand awareness and attractiveness.

I also like that fact that all of its associates have businesses in emerging markets; where the penetration rate is still low and there is a huge room for improvement.

Quality growth

I believe Singtel would take on the path of Verizon and AT&T in the U.S when T-Mobile was introduced as a new player.

T-mobile was agressive in gaining market share and cutting ARPU across the US. Both incumbents, however, chose the route of modest growth with maintain ARPU and quality EBITDA. Similarly, T-Mobile, although revenue was exploding with growth, had its profitability struggling due to its pricing strategy.

The "older generation" effect

Like DBS/POSB, Singtel has the blessing of the "older generation", where our fathers and mothers tend to stick with Singtel.

Aiyah, why change leh. I use Singtel so many years already, don't change la. Everything is ok mah.

So how?

What do you think? Is Singtel is good enough buy, especially in the current minor sell down?

I know I'll be accumulating if it reaches my target price. What about you?

Hi I think Singtel is diversified too, but if you look at their Group Digital Life segment, it has been suffering widening losses even for the last reporting period. I'm not sure if they have what it takes to succeed there. The point of developing that segment was to seize and capitalise on mkt share currently dominated by major app developers and online service providers. So far they've not been succeeding in that.

ReplyDeleteAlso amongst the three telcos, Singtel reported the lowest return on assets. Part of it is probably due to its size. The larger a company is, the harder it is to grow more.

Hi Investor!

DeleteYes I agree that their GDL segment have widening losses. However, what's less worrying is the impact to bottom line being less than 5%.

Also, there should be profitability kicking in when their products gain traction and scales up.

Lastly, the recent change in leadership for GDL could help make this segment profitable.

The bad side is that the expenses from those losses are not one-off in nature. I'll be watching a close eye on this segment and make sure the impact overall isn't too huge.

Cheers!

Hi Investor,

DeleteI looked thru the telcos while doing a class project in school last year. The reason why Singtel has a lower ROA is due to Singtel capitalizing their leased assets. They treat their satelitte as finance leases. For M1 and StarHub, their leased assets are taken as operating leases, and thus taken off balance sheet, reporting a lower asset and liability base. Hope I clarified a little!

LS

Hi Investor,

DeleteI looked thru the telcos while doing a class project in school last year. The reason why Singtel has a lower ROA is due to Singtel capitalizing their leased assets. They treat their satelitte as finance leases. For M1 and StarHub, their leased assets are taken as operating leases, and thus taken off balance sheet, reporting a lower asset and liability base. Hope I clarified a little!

LS