DS is slightly different from the more popular Kingsmen Creative which specialises in Corporate/Retail Interiors, Exhibitions/Events, Theme parks & Museums.

3 Business Segments

Residential - supply and install products like Kitchen cabinets, vanity cabinets, wardrobes etc.

Commercial - Interior fitting out to Hospitality and Commercial developments

Distribution - Distribute imported brands in Singapore

Notable clients

- Trump Tower, Las Vegas

- Burj Khalifa, Dubai

- Resorts World Sentosa

- Marina Bay Sands

- City Developments

- Capitaland

- Keppel Land - Reflections at Keppel Bay

- GoucoLand Limited

- Far East Organisation

- South Beach Mixed Development

- Westin Hotel, Marina Bay

These big names bodes well for DS' reputation, helping them to gain more clients in the future.

Valuations

Design Studio

PE ratio = 6.8

PB ratio = 1.2

Dividend yield = 11.8% (more on that later)

Kingmens Creative

PE ratio = 11.5

PB ratio = 2.0

Dividend yield = 4.0%

Past results

DS revenue has been on a general upward trend for the past 5 years, riding on the wave of the local property market here.

Although the margins have been fluctuating, it is still higher than its peer Kingsmen who enjoys about 5-6% margin instead.

Strong Balance Sheet

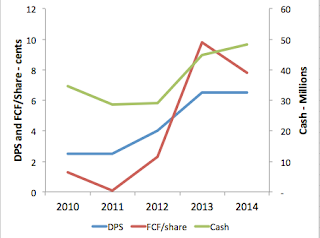

I love the fact that Design Studio has zero debt and sits on heaps of cash. FCF has been in the positive for the last 5 years. The only concern is the erratic FCF, and that sometimes FCF per share is lower than dividend per share. Things are improving for the past 2 years, and I hope DS continues to do so.

Total dividend has been on an upward trend. Ordinary dividend however, was more volatile. Not sure what management had in mind when splitting the ordinary and special dividend proportions.

At current price of $0.54, it's a 11.11% yield.

Looking at their order book, it's likely 2015's dividend will be at least 5 cent - 10.80% yield.

Strong Order Book

Unlike the Oil & Gas companies or Engineering companies, each contract of DS does not last more than a year (typically 3-6 months). This does not provide much visibility and stability in the recognition of revenue for multiple years.

Instead, I would reference their order book for the following year's result. Thus far, 2014's ending order book looks healthy despite the softening property market in Singapore. Their diversified business segments allowed the company to weather through soft markets.

Business Moat?

Integrated Business - Other than manufacturing and installation furniture and fittings, DS also provide interior fitting out, furnishing and design solutions. This allows the company to provide an all-in-one solution for its clients.

Integrated Business - Other than manufacturing and installation furniture and fittings, DS also provide interior fitting out, furnishing and design solutions. This allows the company to provide an all-in-one solution for its clients.

89.81% held by immediate holding company

10.19% held by public as at 11 March 2015

20 of the largest shareholder makes up 98.14% of the shares outstanding.

In normal circumstances, the substantial shareholders would have little to no movement in their shareholders. Effectively, only 2% of the shares are available for trading. This explains why average daily volume is only about 19,000.

Residential segment takes up about half of DS' revenue. The softening property market will have adverse impact on the Group, as evident in the change in order book composition.

The uptick here is that the hospitality segment is poised to pick up the slack due to Singapore Tourism Board effort to spruce up Singapore and bring back the tourists here. New and existing hotels will be potentially DS' client for Alterations & Additions (A&A) services.

I was immediately interested when I found out the strong balance sheet and FCF ability they had in recent two years. I've initiated a small position with DS back then. Now that I've found out about their moat and past clients, I will probably add more to the position. I hope I'm right though.

I'm also watching out for that public float percentage.